Employers are you ready?

Action needed now for New Reporting Requirements in 2024

Revenue have released enhanced reporting requirements for employers to take effect on 1 January 2024. Employers will be required to electronically notify Revenue of a number of tax free payments or benefits made to an employee/directors in real time.

The payments or benefits are as follows:

- The remote working daily allowance of up to €3.20 per day

- The payment of travel and subsistence expenses:

- Vouched travel & subsistence

- Eating on site allowance

- Emergency travel

- Country money

- Unvouched travel & subsistence e.g. civil service mileage rates

- Small benefits covered by the small benefit exemption – vouchers or benefits provided to an employee – up to 2 small benefits each year which do not exceed value of €1,000

Information required by Revenue:

- Employee’s details

- Amount paid

- In the case of remote working, the number of days

In Addition:

- These must be reported in real time - on or before pay date.

- The enhanced reporting requirements will incur extra time each pay period to return the extra information to revenue – it is separate from payroll submissions currently being filed.

- To note use of company fuel cards or credit cards are not required to be reported only non-taxable payments above to be submitted.

- Employees will be able to review the submissions made for them by their employer through their myAccount.

What to do now?

- Familiarise yourself with the additional reporting requirements. Click here to view recorded revenue webinar.

- If you currently outsource your payroll to RBK, reach out to your contact in the payroll department and let them know if you want RBK to carry out the enhanced reporting requirements on your behalf

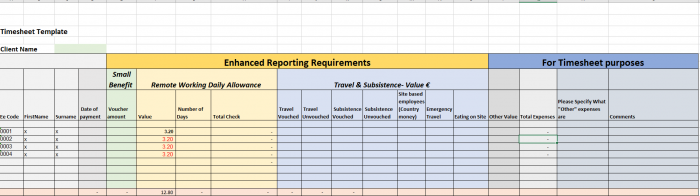

- We will be issuing an expense timesheet to each of our payroll clients (template below) detailing the information that we will require.

- RBK will not need receipts or expense claim form – client to retain these

- If you wish to carry out this process internally and have an accounts/expense package please reach out to your provider to see if the software can support the additional reporting

- You will also need to ensure that you have the necessary access rights on your ROS Digital Certificate to complete submission.

- If uploading through ROS Revenue will accept XML/Json files only – revenue will not be providing template to employers.

- Link below to revenue on what they require in file:

ERR - Enhanced Reporting Submission Request Data Items.pdf

- Please ensure when submitting that the employment ID being used must be the same ID that is reported to Revenue via Payroll submissions currently being filed.

- Ensure you are up to date with the current payroll legislation and ensure you are paying expenses correctly. Access Revenue update here.

- Review your practice on paying expenses – will you need to change the frequency of paying expenses?

How can RBK help:

- RBK have an outsourced payroll department who are up to date with payroll legislation. Our payroll software will be updated to support the new reporting requirements.

- Assist with guidance on what is to be reported with the help from our Tax Department

- Contact Mary Byrne, Senior Manager, RBK Payroll Solutions for assistance / advice – payroll@rbk.ie / (090) 6480600.

Additional information:

- Penalties of €4,000 will apply for failure to comply with submitting ERR to revenue on or before the date the payment is made to an employee or comply with any ERR regulations – however there will be a settling in period before this is applied.

- Payroll clients of RBK may need agent links updated and clients will be contacted on individual basis where this needs to be updated – please return form as soon as possible once received