In a world of fast-evolving tax rules, increased cross-border activity, and heightened regulatory scrutiny, transfer pricing is no longer just a compliance issue. It is a strategic business imperative. Our dedicated Transfer Pricing team brings hands-on experience across a wide range of sectors, helping clients navigate complex legislation and design solutions that are not only defensible, but commercially aligned and future-ready.

From aligning pricing policies with operational reality to preparing robust documentation and managing tax authority interactions, we go beyond templates; we tailor. Grounded in OECD principles and attuned to Ireland’s specific transfer pricing regime, we work with businesses of all sizes to manage risk, meet reporting obligations, and build resilient, scalable transfer pricing strategies.

Whether you are responding to OECD’s BEPS developments, preparing for a local file submission, or rethinking your intercompany pricing model altogether; we are here to support you every step of the way.

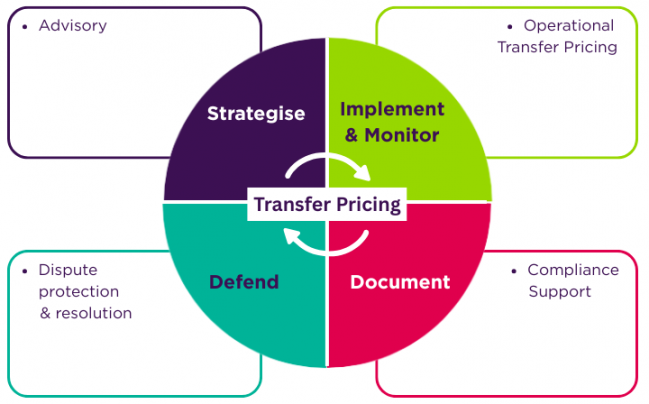

Our services go hand in hand with the transfer pricing cycle a taxpayer typically goes through. From early-stage strategy to implementation & monitoring, compliance, and dispute resolution, our end-to-end approach ensures that your transfer pricing framework is robust, adaptable, and aligned with both business goals and regulatory expectations.

At RBK, we focus on delivering practical, commercially grounded transfer pricing solutions that meet your compliance obligations while supporting your wider business goals. Our team keeps pace with evolving regulations and industry developments to provide insights that matter. Whether you are just starting to formalise your transfer pricing framework or looking to enhance and defend existing arrangements, we are here to support you every step of the way, with advice that is tailored, timely, and aligned with your business.

We help businesses lay the groundwork with clear, defensible strategies based on a deep understanding of their operating model, value drivers, and global risk profile.

We support you in translating your strategy into practice, ensuring your transfer pricing policies are not just well-designed, but effectively implemented across systems,…

We help you meet your compliance obligations with confidence, ensuring your transfer pricing documentation also reflects the reality of how your business operates.

We support businesses in managing transfer pricing disputes through a practical and informed approach. Our aim is to minimise the risk of disputes by ensuring your…

Transfer Pricing 1.52 MB

In a world of fast-evolving tax rules, increased cross-border activity, and heightened regulatory scrutiny, transfer pricing is no longer just a compliance issue. It is a strategic business imperative. Our dedicated Transfer Pricing team brings hands-on experience across a wide range of sectors, helping clients navigate complex legislation and design solutions that are not only defensible, but commercially aligned and future-ready. RBK Transfer Pricing Brochure

DownloadOur offices are strategically located to service our market and are easily accessed from any location nationwide.

Termini,

3 Arkle Road,

Sandyford, Dublin,

D18 C9C5, Ireland

RBK Incorporating OMC O'Malley & Company Limited,

Upper Chapel Street,

Castlebar, Co Mayo,

F23 PF21, Ireland

RBK House, Irishtown

Athlone,

Co. Westmeath,

N37 XP52, Ireland

RBK Incorporating MCP Accountants,

Breaffy Road,

Castlebar, Co Mayo,

F23 DY67, Ireland