In today’s global economy, transfer pricing is a critical consideration for multinational enterprises operating across borders. Irish tax legislation has always had the concept of “wholly and exclusively” when considering the deductibility of trading expenses. Irish revenue equate the “wholly and exclusively” provision as a requirement that expenses to be deductible for trading purposes should be “arm’s length”. Formal “light touch” transfer pricing legislation was introduced in Ireland in 2010 with a significant overhaul in 2019, now aligning closely with the OECD Transfer Pricing Guidelines.

The Finance Act 2019 introduced comprehensive TP rules applicable to accounting periods commencing on or after 1 January 2020. These rules mandate that intercompany transactions be conducted at arm's length, ensuring that profits are appropriately allocated and taxed. The Finance Act 2021 further introduced application of the “Authorised OECD Approach” for the attribution of income to Irish branch/ agency of a foreign entity, as a part of which the Irish branch/ agency is required to prepare and maintain relevant branch records.

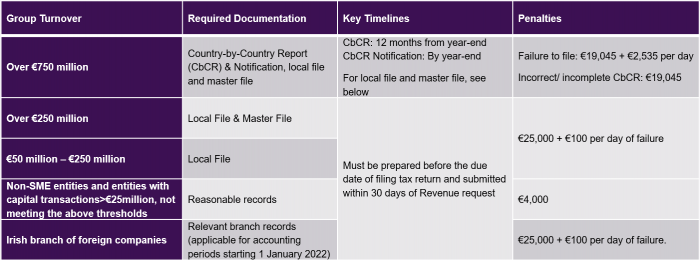

These rules also brought in the following TP documentation requirements:

Small and Medium Enterprises (“SME”) are currently exempt from transfer pricing documentation rules. However, it is important to note that the extension of formal transfer pricing provisions to SMEs is subject to the making of a commencement order by the Minister for Finance.

Key considerations

- The CT1 form has TP specific questions which provide crucial information to Revenue on the MNE Group the Irish taxpayer belongs to and its applicability of the Irish TP documentation requirements.

- Irish Revenue has increased recruitment within its Transfer Pricing team, signalling enhanced focus and enforcement in this area.

- Revenue may initiate a Transfer Pricing Compliance Review (TPCR) under its Level 1 intervention framework. A TPCR can escalate to a full audit if risks are identified. Depending on the complexity, materiality, and taxpayer behaviour, Revenue may also intervene directly at Level 2 or 3 for more in-depth reviews or investigations.

- The recent Tax and Duty Manual Part 35A-01-05 outlines Revenue's approach to requesting transfer pricing documentation during audits, indicating a heightened focus on compliance. Notably, in Ireland's first transfer pricing case, the Tax Appeals Commission ruled in favour of the taxpayer, emphasising the importance of maintaining robust and contemporaneous documentation to substantiate transfer pricing positions.

- TP documentation is the first line of defence for taxpayers and complying with the documentation requirements on a timely basis provides Irish taxpayers with tax geared penalty protection to TP adjustments arising within “careless” (not “deliberate”) behaviour category of default.

How can we help you?

Transfer pricing compliance is not just a box-ticking exercise — it requires thoughtful coordination, clear documentation, and a good understanding of how your business creates value across borders. Our team brings a wealth of experience in managing complex transfer pricing projects, both in Ireland and internationally.

The professionals in our team have supported clients across a broad range of industries and transaction types, helping them interpret and respond to evolving regulatory expectations. With professionals having experience working for clients in key jurisdictions, our insights are grounded in hands-on knowledge of how similar OECD-based documentation regimes operate in practice.

Whether you are preparing your first Local File, refreshing or designing group-wide transfer pricing policies, undertaking a modelling exercise, reviewing existing documentation, or carrying out a TP risk assessment, we deliver practical, commercially grounded support that fits your needs and offers real value for money.

At RBK, we offer tailored transfer pricing solutions that align with your business objectives while ensuring compliance with both Irish and international tax regulations. If you would like to explore how we can support you through the Irish TP documentation requirements and beyond, we would love to talk to you.

Disclaimer: While every effort has been made to ensure the accuracy of information within this publication is correct at the time of going to print, RBK do not accept any responsibility for any errors, omissions or misinformation whatsoever in this publication and shall have no liability whatsoever. The information contained in this publication is not intended to be an advice on any particular matter. No reader should act on the basis of any matter contained in this publication without appropriate professional advice.