Can I use my pension to buy property?

Yes. You can use your pension to invest in property, however, the Revenue Commissioners state that it must be for the sole purpose of providing benefits on retirement. What that means is that there are some restrictions that investors should be aware of.

What are the main restrictions?

The main restriction are:

- It must be at “Arm’s Length”, which means that the property may not be used by you or anyone connected to you, which includes your business.

- There are also rules in relation to liquidity within the pension that need to be followed.

- A property manager needs to be appointed.

Can I borrow to fund the purchase?

It is possible for your pension to borrow to purchase the property, however like any other borrowing you will need to provide a good business case to the financial institution to support the application. The maximum term of any loan is 15 years or your normal retirement age, whichever is sooner and there are limits on the loan to value ratio.

What are the advantages?

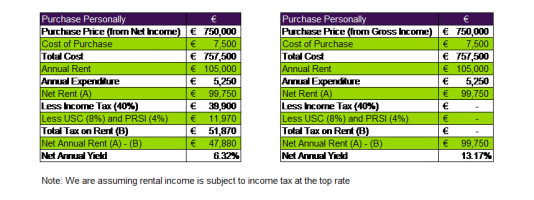

The big advantage is tax. There is tax relief on both personal and company contributions. Rental income earned within the pension is tax free and when it comes to the sale of the property, the sale is free from Capital Gains Tax. This can be very attractive when one considers the income tax and capital gains tax arising where the property is held personally. We have set out below a simple comparison of both scenarios.

What happens when I retire?

The property can be sold to provide retirement benefits or it is possible to transfer the property into a post retirement product such as an Approved Retirement Fund and use the rental income to pay pension benefits.

Is it right for me?

Purchasing property through a pension doesn’t suit everybody. It, is therefore important that you get good advice before you make any decisions. We, recommend you talk to our Wealth Management Department to find out your options and whether investing in property through your pension fund is appropriate for you.